Present value of lease payments excel

N is the number of periods. Present Value Calculator Help.

Calculating Present Value In Excel Function Examples

Exhibit 3 shows the lease accounting.

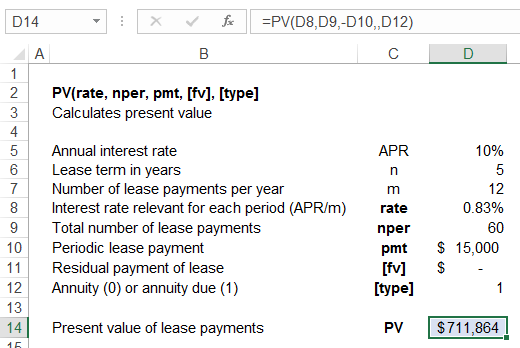

. Ownership of the asset may be transferred to the lessee at the end of the lease. Present value is the opposite of future value FV. For annuity due where all payments are made at the end of a period use 1 for type.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The lease payments due at Dec. An operating lease is a contract that allows for the use of an asset but does not convey rights of ownership of the asset.

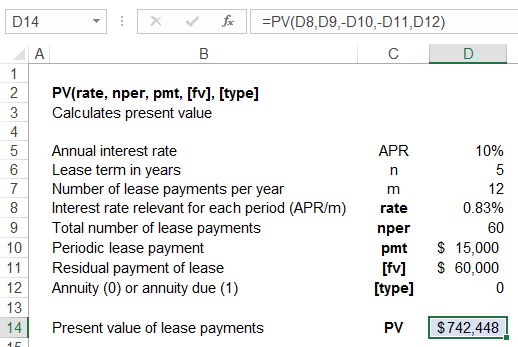

CR Lease Liability 136495. Instructions for using the calculator are as follows. Follow the steps below to calculate the present value of lease payments and the lease liability amortization schedule using Excel when the payment amounts are not constant illustrated with an example.

The Excel monthly lease payment calculator available for download below computes the monthly lease payment by entering details relating to the cost and residual value of the asset the lease interest rate and the number of payments and advance payments required by the lease agreement. CF Future Cash Flow. The template also features Taxation Data.

Fixed at 20 per year. FV is the future value. PV Present Value.

It also creates a corresponding Lease Liability based on the same calculation. Our monthly rate is 025 and the present value of all monthly lease payments over 5 years is CU 55 708. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

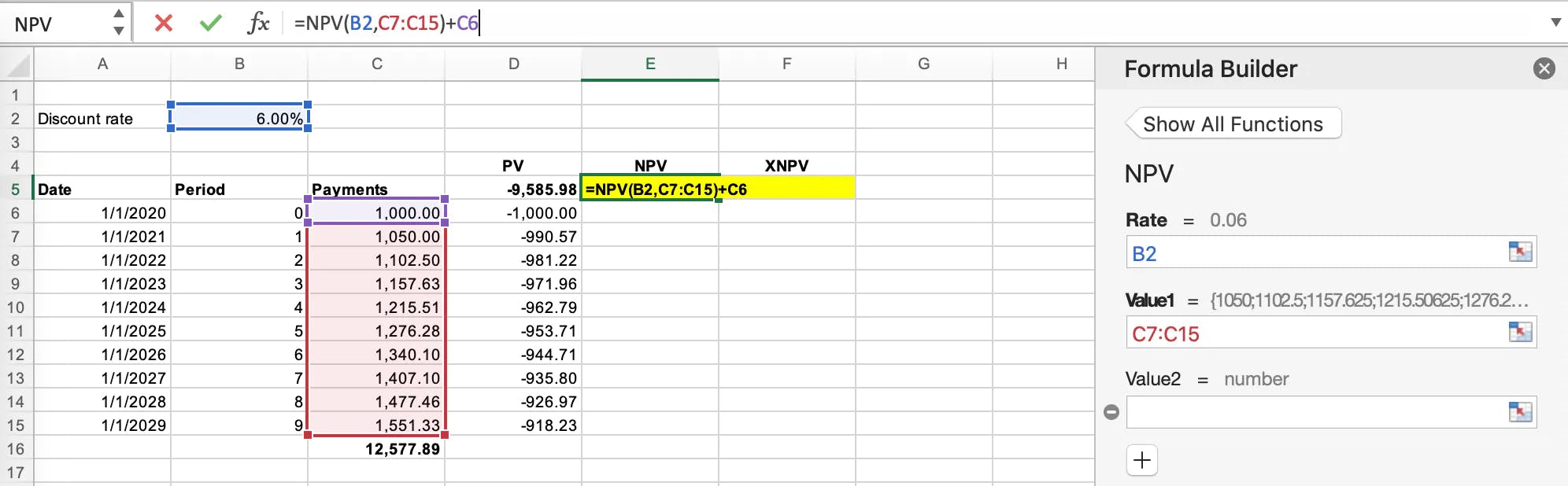

The lease liability is the foundation of lease accounting under ASC 842 as the lease liability is the present value of future lease payments. T Number of Years. While the opposite is true for a negative NPV.

Calculate the present value of lease payments for a 10-year lease with annual payments of 1000 with 5 escalations annually paid in advance. Equals the residual value 13110. The present value of lease rentals is equal to or greater than the assets fair market value.

Given 1000 today it will be worth 1000 plus the return on investment a year from today. Go to Download Car Buy vs Lease Calculator for Excel. The Present Value Formula An Equation Present Value Calculation Download our Excel Template Here.

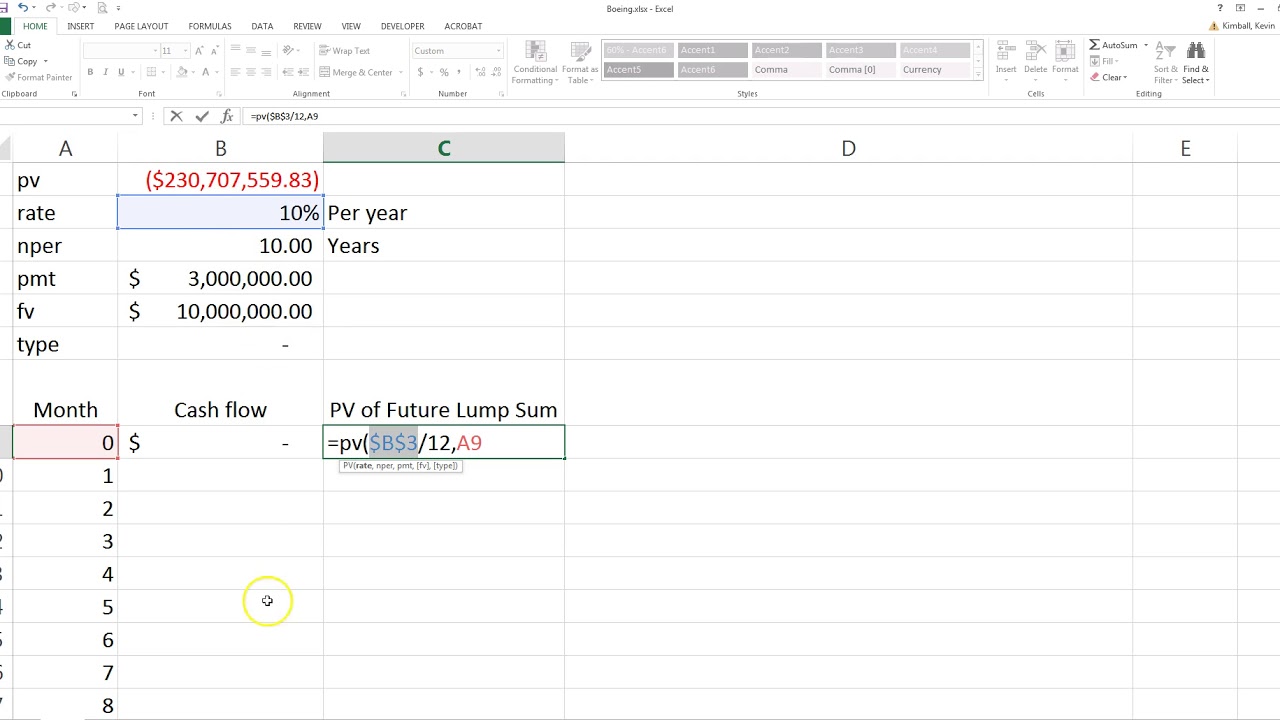

In order to calculate the present value of lease payments judgements will need to be made on the following inputs when calculating the present value. When you use the PV function in excel it details the arguments used in the function. This lets us find the most appropriate writer for any type of assignment.

If you are schedule to receive 100000 a year from today what is its value today assuming a 55 annual discount rate. Tax Rate This is the average tax rate for your company with a standard assumption of 20. Schedule of Payments The lease will spell out upfront and ongoing payments due which provides an effective interest rate.

I have lots of practical examples solved in Excel related exactly to these issues within my IFRS Kit so make sure you check that out. Based on this information the lease asset will initially. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

A positive value means the Difference is in favor of leasing while a negative value is in favor of buying. Present value of lease payments explained. Sticker price MSRP of the car.

The interest rate per periodFor example if you obtain an automobile loan at a 10 percent annual interest rate and make monthly payments your interest rate per month is 1012 or 083. Discount Rate This is the rate used in cash flow analysis to account for the time value of money. 5 this is close to the rate the company would pay on secured debt.

1 the lease term represents 100 of the useful economic life of the underlying asset and 2 the present value of the lease payments equals the fair value of the underlying asset. The rate of interest that at a given date causes the aggregate present value of a the lease payments and b the amount that a lessor expects to derive from the underlying asset following the end of the lease term to equal the sum of 1 the fair value of the underlying asset minus any related investment tax credit retained and expected. The lease contains a bargain purchase option for the lessee to buy the equipment below market value at the end of the lease.

These are the figures we are going to use to establish the present value. This lets us find the most appropriate writer for any type of assignment. Times the residual value percentage.

So the first input of the calculation to figure out is what are future known lease payments at commencement. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates. For ordinary annuity.

Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time. PV is the present value the principal amount of the annuity. The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year.

The lease asset value begins with the amount calculated as the lease liability. Lessee will record the fair value present value of min lease payments of the asset on lease at both the asset and liability sides of the balance sheet. At the end of the table you can see that the template automatically computes for the Difference with a Note to guide you.

Heres the video. In addition to the present value of future lease payments the asset value includes prepaid lease payments less any lease incentives received from the lessor prior to the commencement of the lease term. R Discount Rate.

This is your right-of-use assent and the lease liability at the commencement date. A plan that allows employees to donate unused sick-leave time to a charitable pool from which employees who need more sick leave than they are normally allotted may draw. Rental price 70 per night.

The present value of the lease payments is greater than or equal to 90 of the fair value of the asset. An operating lease represents an off-balance sheet. This lease is a finance lease for two reasons.

Master excel formulas graphs shortcuts with 3hrs of Video. FV 1 rn. The most common financial functions in Excel 2010 PV Present Value and FV Future Value use the same arguments.

Negotiated selling price of car. R is the required rate of return. Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments to.

Initially the company creates a Lease Asset based on the Present Value of the lease payments over the next 10 years.

How To Use The Excel Pv Function Exceljet

How To Calculate The Present Value Of Lease Payments In Excel

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Gym Financial Model Excel Template Excel For Business Financial Planner Tracker Business Planner In 2022 Successful Business Owner Financial Business Planner

Explore Our Example Of Real Estate Investment Analysis Template For Free Planilhas

On January 1 Of The Current Year Tire Company Enters Into A Five Year Lease Agreement For Production Equipment The Lease Requires Tire Co To Pay 12 500 Per This Or That

How To Calculate The Present Value Of Lease Payments Excel Occupier

Calculating Present Value In Excel Function Examples

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Future Lease Payments

Free Free Parking Space Rental Lease Agreement Template Pdf Parking Space Rental Agreement T Rental Agreement Templates Lease Agreement Agreement

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

How To Calculate The Present Value Of Future Lease Payments

Receipt Form Free Printable Documents Free Receipt Template Receipt Template Lease Agreement Free Printable

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel